How to Send a Compliant Token Bonus Through Franklin

Aug 31, 2023

This post was a collaboration with Mackenzie Patel at Hash Basis.

This post was a collaboration with Mackenzie Patel at Hash Basis.

Many teams in web3 want to be able to compensate their teams with crypto native assets, but are unsure of how to navigate the tax implications of doing so, or find that it's too cumbersome to execute properly. Hash Basis and Franklin have come together to break down the accounting and tax components to consider as well as how to execute these types of transactions in a streamlined manner on-chain.

Setting the Stage: Case Study from On-Chain Inc.

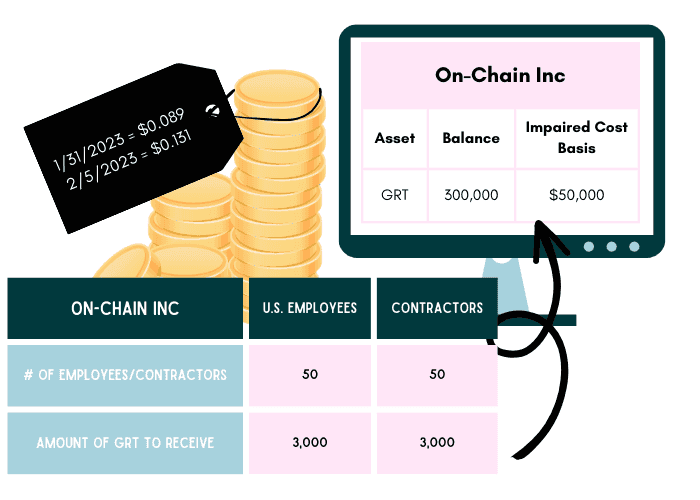

For this article, we thought an example from a fictional corporation would best illustrate how to send a token bonus and properly account for it. On-Chain Inc is a C corporation that has a mix of US-based employees and international contractors. The company runs validators across several Proof-of-Stake blockchains and earns the majority of its revenue in native tokens. On-Chain Inc wanted to send all employees and contractors a bonus in GRT, the native token of The Graph blockchain. The target distribution date was January 31, 2023. The price of GRT on January 31, 2023 was $0.089. The token was actually sent a few days later on February 5, 2023, when the price of GRT was $0.131. Each employee and contractor received 3,000 GRT tokens. There are 50 employees across the US and 50 contractors. Per the company's crypto subledger, the impaired cost basis for the 300,000 GRT is $50,000.

Current State of Digital Asset Accounting

Under current US GAAP rules, non-stablecoins and NFTs are classified as intangible assets on the balance sheet. Under this method, there is no mechanism to increase the value of the asset, only decrease it to the lowest price during the period (also known as impairment). This has led to crypto company balance sheets not accurately reflecting the value of their assets since they’re constantly being written down. For example, a company could hold 100 ETH on the balance sheet at $170,000 (which implies an impaired value of $1,700 per ETH), when the current price of ETH is $2,500. If the balance sheet was showing the fair market value, it would reflect $250,000 instead.

However, there is good news for crypto companies & accountants! The FASB (the governing body that sets US GAAP rules) is slated to change the treatment of crypto assets from cost less impairment to fair market value. This means digital assets (likely excluding stablecoins, wrapped tokens and NFTs) will be on the balance sheet at their current value as of the reporting date. Any change in fair value (i.e. price fluctuations) will flow through the income statement. We recommend reading through the comment letters to this proposed update (you can find Hash Basis’ here!) to learn about the technical changes and what the crypto accounting community thinks.

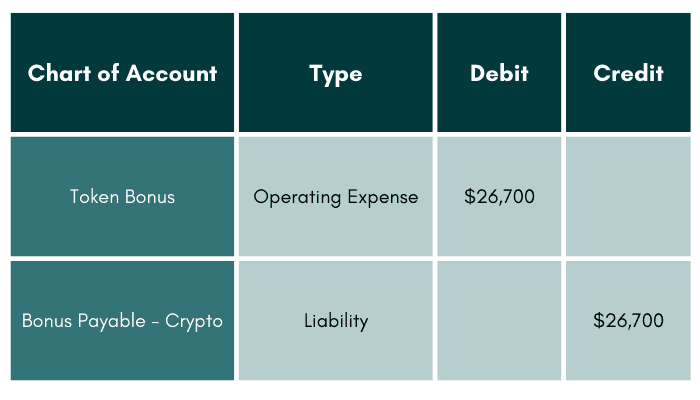

Accounting Entries for Sending a Token Bonus

In our case study above, GRT would be considered a vanilla digital asset (i.e. not a stablecoin or NFT), meaning it should be reflected at its impaired value today and fair market value later once the FASB publishes the new standard. Since there are 100 people receiving the bonus, the total amount of the bonus expense is 100 people * 3,000 GRT tokens each * $0.089 (price on January 31) = $26,700. This bonus expense is accrued on January 31, 2023 since January is the time period the bonus applies to.

Note: the accruals for social security, medicare and income tax can also be recorded now. For simplicity, we’ll be recording them when the GRT is paid.

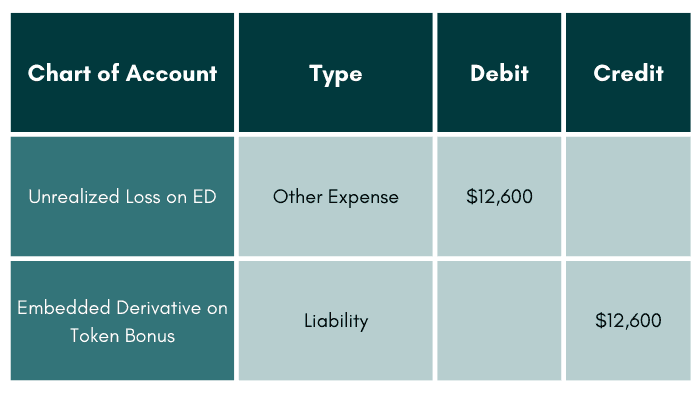

However, the bonus is actually remitted on February 5, 2023, a full five days later. Since the price increased to $0.131, the company now needs to book an unrealized loss since the value of their liability increased by $12,600 ([$0.131 - $0.089] * 300,000 GRT). This is also known as an embedded derivative (ED for short), which is defined under US GAAP as,Implicit or explicit terms that affect some or all of the cash flows or the value of other exchanges required by a contract in a manner similar to a derivative instrument. ASC 815-15-20You can think of an embedded derivative as a hybrid instrument that has derivative-like qualities, but that wouldn’t meet the definition of a pure derivative by itself. Under ED guidance, the derivative is separated from the “host contract” and accounted for separately on the balance sheet. And because it’s US GAAP, we have three criteria to check to see if our GRT bonus has an embedded derivative hiding within it:The price of GRT is not “clearly and closed related” to the bonus. Criteria b. and c. are also satisfied.In derivative-speak, the underlying here is the fluctuating price of GRT and the notional is the 300,000 GRT allocated for the bonus. The entry for recording this change in value is as follows (this flows through the income statement in February):

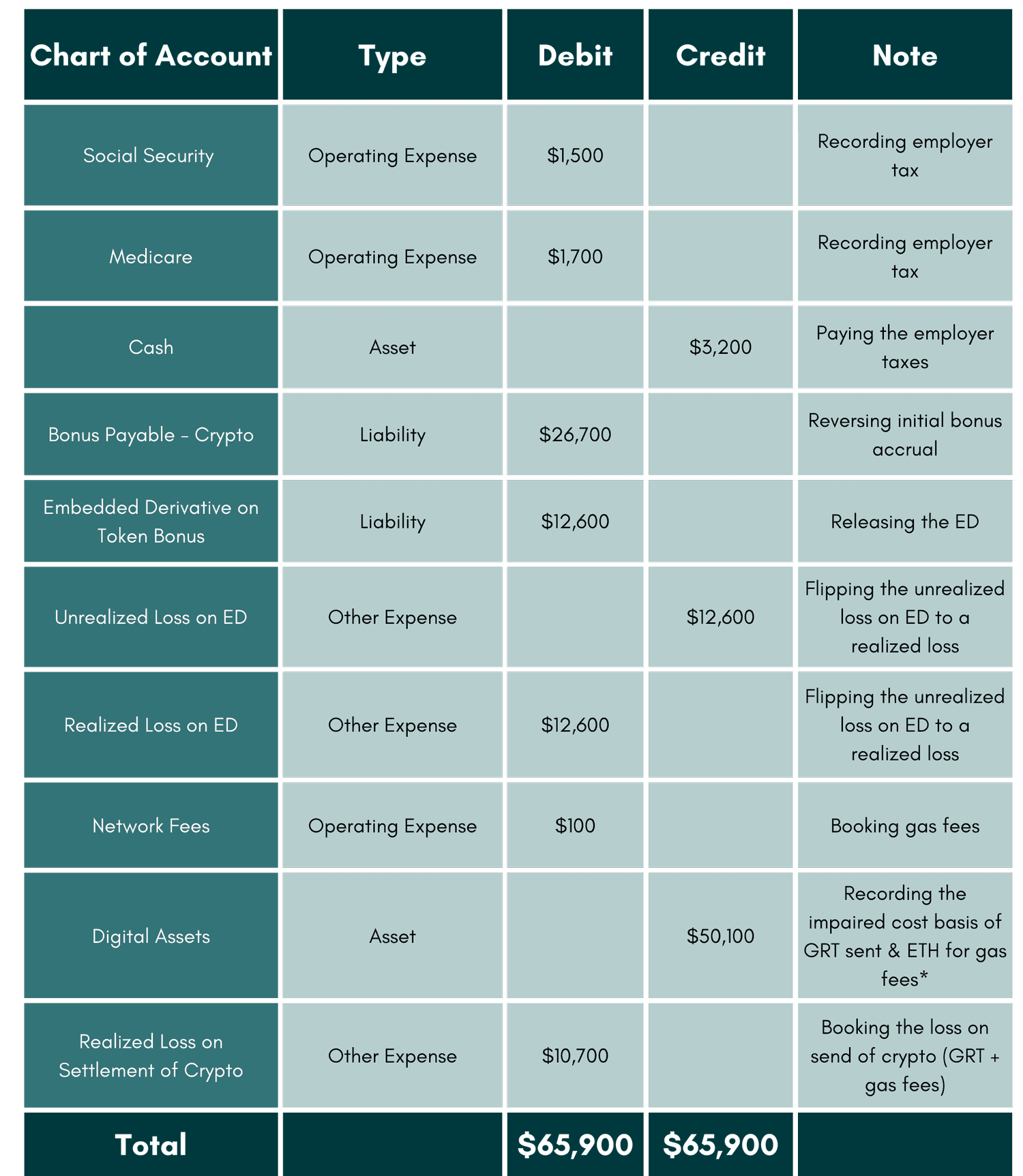

At this point, the accountant can jump over to Franklin and enter the amount of the bonus for each employee and contractor. Payroll taxes will automatically be calculated and posted to the general ledger. The employee entry might look like this:

For simplicity, we’re ignoring the employee side of taxes such as federal income tax, state income tax, FICA, etc.

Note: the embedded derivative is “flipped” once the realization event (i.e. send of the token bonus) occurs. The unrealized loss is converted to a realized loss so the total realized loss on this transaction is $23,300 ($12,600 + $10,700).

* assume of the cost basis of the ETH paid for gas fees is $100

Digital Asset Taxation

Something that is confusing for company operators is the need to hold separate accounting and tax books. The above entries are not enough to be able to calculate the associated gain/loss on the asset since in the US, digital assets are taxed as property. Impairment also is not factored in the tax cost basis because it’s a non-cash expense (i.e. it doesn’t represent a realization event). To calculate the gain/loss associated with the disposition of crypto assets, you need the following:

Amount

Cost basis

Cost basis methodology

Date of acquisition and date of disposition (which calculates the holding period)

Fair market value (current price) at time of disposition

The most common cost basis methodology for US companies is FIFO (first in first out), but there are other methods including LIFO (last in first out), ACB (average cost basis), HIFO (highest in first out). Per the IRS, taxpayers can only use FIFO or Spec ID (LIFO & HIFO are variations of Spec ID) and the methodology should stay consistent year over year.

Note: it’s recommended to have a crypto subledger that can handle multiple cost basis “views” so you can separate accounting & tax books more easily.

Tax Treatment Considerations for a Token Bonus

When sending out the GRT bonus, On-Chain Inc. will need to calculate the applicable gain/loss related to the transaction. Even if both the accounting and tax books are under FIFO, the realized gain will need to be recalculated to remove any impairment baked into the cost basis. For our purposes, let’s say recalculating the loss under tax FIFO leads to a realized loss of $12,000. Since impairment is removed for tax, this leads to a higher cost basis and therefore, a smaller loss.

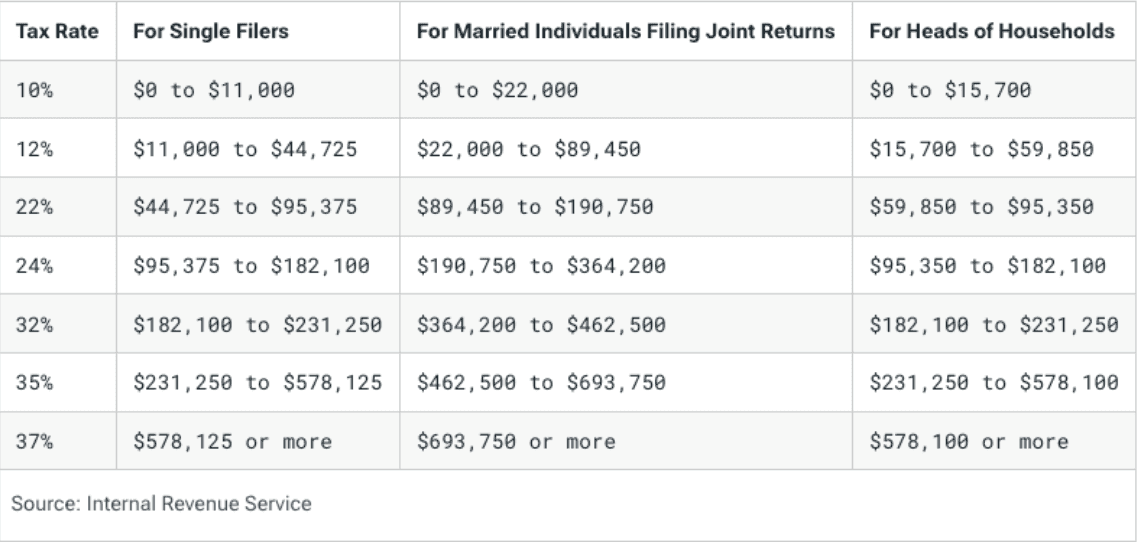

This figure will land in Form 8949, in either the short or long term section depending on the holding period. If the GRT was held for <1 year, it will be subject to short term ordinary rates and if held for > 1 year, it will be taxed at preferential rates (0%, 15%, 20%).

In addition to the digital asset tax considerations, the company will also need to withhold and remit payroll taxes, which are automatically calculated by Franklin.

U.S. W2 Employee Income Tax & Contractor Implications

For employees that get paid this bonus through Franklin, their year end W2 will reflect all of the appropriate withholdings associated with the bonus calculation in USD. The W2 however will not reflect the gain/loss associated with any subsequent trading activity that takes place after the bonus is received.

For contractors based in the United States, the contractor will receive a 1099 in January of the following year. It will only reflect the USD equivalent amount of the asset received. As with other income payments made to contractors, it is the responsibility of the contractor to make estimated tax payments against their income, since none of it is withheld at the company level.

For contractors outside of the United States, no tax form will be generated. However, the contractor can always review their payment history within the Franklin app to be able to calculate the tax liability they have in their local jurisdiction.

Conclusion

Companies that use digital assets to pay their teams need the right tools in place to help them stay compliant. A payroll system like Franklin will ensure that the company is properly calculating, withholding, and reporting taxes to its workers and the tax authorities. A crypto subledger can sync transactions to do the proper double entry accounting and provide the basis to run capital gain/loss tax liabilities. Teams like Hash Basis can provide the professional guidance needed to book, report, and strategize about these types of transactions and more.

Disclaimer: None of the above should be considered legal advice. The above does not consider or advise the distribution of digital assets that are considered securities in the United States.