2026 Federal Income Tax Brackets

Jan 2, 2026

Progressive, national income tax brackets were implemented in 1913 from the 16th Amendment.

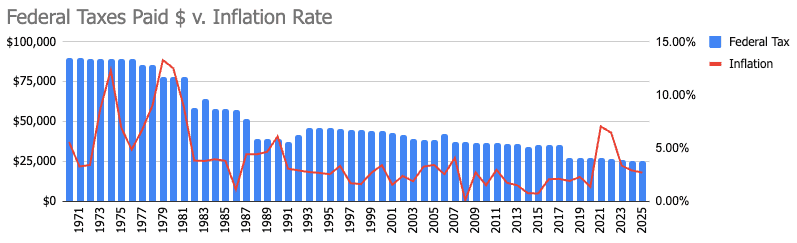

Progressive, national income tax brackets were implemented in 1913 from the 16th Amendment. Tax brackets and rates have fluctuated wildly since the implementation of this tax. Income taxes hit a high watermark of 77% during the 1970s. In the time since, income tax payable for mid-range workers (control case of $150k annual salary) have lowered over time, despite what inflation rates were.

Sample Worker: $150,000 Annual Salary

2026 Brackets Compared to 2025

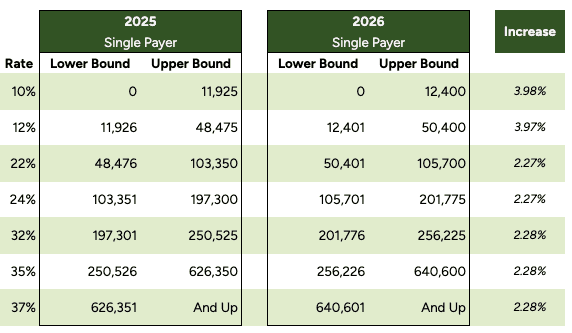

The federal tax brackets in 2026 changed only very slightly. The IRS has maintained the historical 7 brackets and kept the rates the same. The upper bands have increased on average 2.7% which is the same rate of inflation ending in November 2025.

The standard deduction also increased 2.22% from $15,750 in 2025 to $16,100 in 2026.

This generally means that people who are largely making the same amount in 2026 as they did in 2025 are paying a slightly lower amount in federal taxes than they have in the past. This might differ for those who are on the edge of the upper bound of income tax bracket categories.

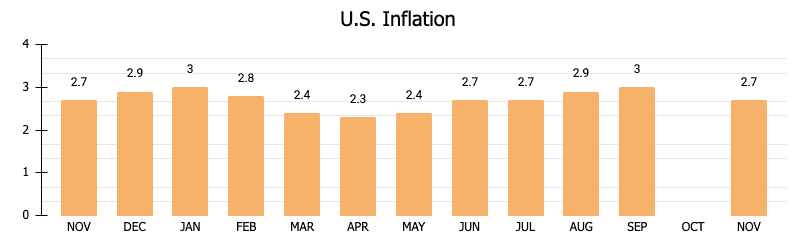

The rolling 12 month average inflation was 2.71% (excluding October 2025 for which no data are available due to the government shutdown).

Adapted from: https://tradingeconomics.com/united-states/inflation-cpi

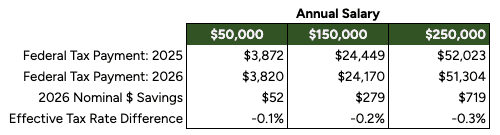

Let’s look at the impact on real paychecks:

Federal Tax Payments Adjusted for Standard Deduction

Americans across tax brackets will save a few basis points on their effective tax rates with the exception of the highest earners, whose top income tax remains at 37%.

Americans can largely expect to pay slightly less in federal income in 2026.