1099 Tax Filings Explained

Jan 6, 2026

The 1099 tax forms are used by U.S. taxpayers to report income from sources outside of payments from an employer to the IRS.

Schedule a 15 minute consultation with our team to learn more.

The 1099 tax forms are used by U.S. taxpayers to report income from sources outside of payments from an employer to the IRS. With approximately 20 different types of 1099 forms there are many ways to classify and report income. Ranging from venmo transactions to freelancer compensation to crypto, there is a 1099 for almost everything. For the 2025 tax year, the reporting threshold for most companies paying external third parties is $600 (with some exceptions). For the IRS, the 1099s helps to address the issue of reporting the many different ways that people earn income. With the rise of the gig economy being able to track and report income accurately is even more important to the IRS.

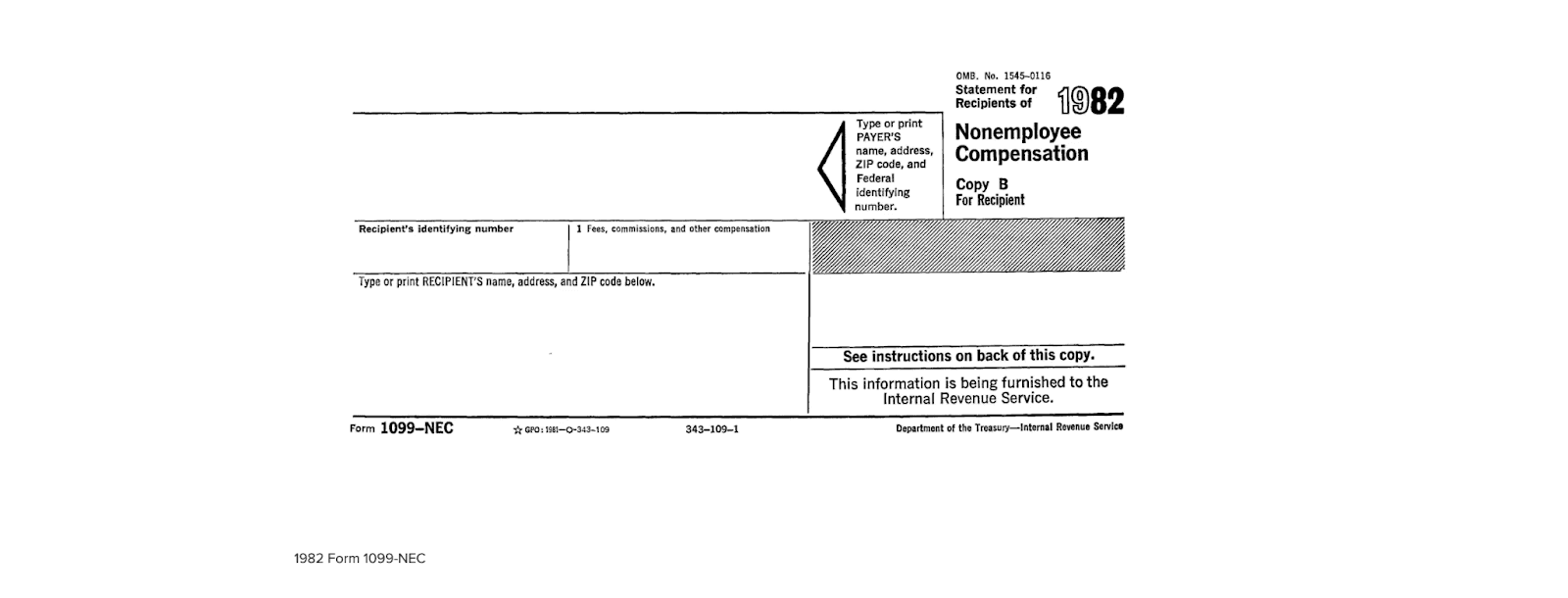

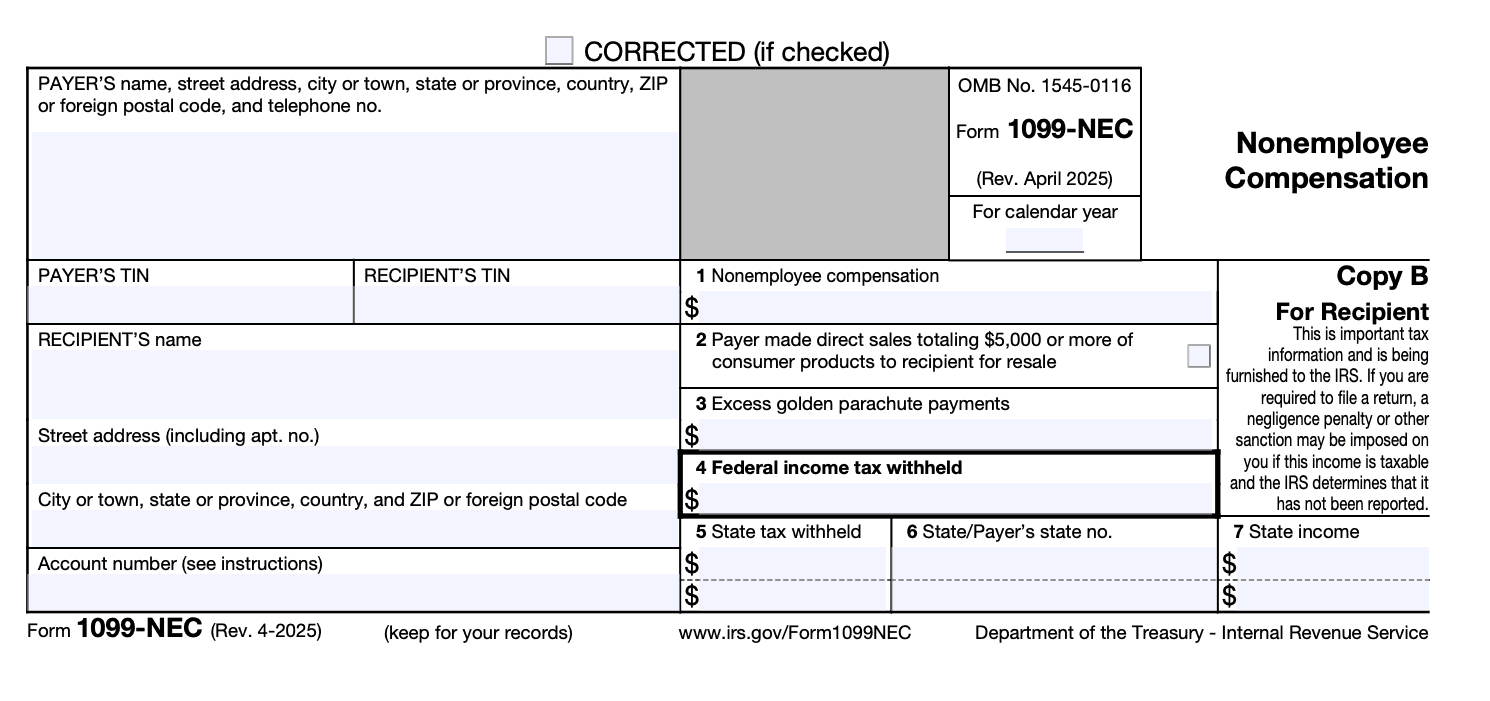

The most common form type is the 1099-NEC which reports non-employee compensation. The Protecting Americans for Tax Hikes (PATH) Act passed in 2015 to address fraud and identity theft. One of the parts of the act requires that non-employee compensation be reported earlier than other miscellaneous compensation. Before the return of the 1099-NEC form in 2020, taxpayers had to separate out different 1099-MISC forms and file them at different times. The IRS brought back the 1099-NEC after deprecating it in the 1980s to make the filing a little less complicated, avoid errors such as double filing, and have a way to address fraud in filings.

1099-NEC Form (1980s):

1099-NEC Form (2020s):

Businesses can easily get confused with so many different 1099 forms to file. The following table is an overview of the purpose of each type of form, where you can find it, and its filing due date. The forms that are the most common for Franklin users are in bold italics.

Form Type | Description | IRS Filing Due Date (2025 Reporting Year) |

Purchase or abandonment of secured property, like in a foreclosure | Paper: February 2 Electronic: February 2 | |

Sale of securities | Paper: March 2 Electronic: March 31 | |

Debt cancellation | Paper: March 2 Electronic: March 31 | |

Changes in corporate control and capital structure (like stock sales) | Paper: March 2 Electronic: March 31 | |

Digital Assets | Paper: March 2 Electronic: March 31 | |

Dividends and asset distributions | Paper: March 2 Electronic: March 31 | |

Government payments like unemployment compensation or state and local income tax refunds | Paper: March 2 Electronic: March 31 | |

Advance payments of the Health Coverage Tax Credit (HCTC) | Paper: March 2 Electronic: March 31 | |

Interest income | Paper: March 2 Electronic: March 31 | |

Payment card and third-party network transactions (like Venmo and Paypal) | Paper: March 2 Electronic: March 31 | |

Life insurance sale | Paper: March 2 Electronic: March 31 | |

Income from long-term care and accelerated death benefits | Paper: March 2 Electronic: March 31 | |

Rents, royalties, prizes, awards | Paper: March 2 Electronic: March 31 | |

Non-employee compensation payments | Paper: February 2 Electronic: February 2 | |

Original issue discount from bonds or certificates of deposit | Paper: March 2 Electronic: March 31 | |

Cooperative income | Paper: March 2 Electronic: March 31 | |

Payments from qualified education plans like 529s | Paper: March 2 Electronic: March 31 | |

Distributions from Achieving a Better Life Experience (ABLE) account | Paper: March 2 Electronic: March 31 | |

Pensions, annuities, retirements, profits-share, IRAs, and insurance contracts | Paper: March 2 Electronic: March 31 | |

Proceeds from real estate transactions | Paper: March 2 Electronic: March 31 | |

Healthcare Savings account (HSA) or Medicare Advantage (MSA) distributions | Paper: March 2 Electronic: March 31 | |

Sellers investment in a life insurance contract | Paper: March 2 Electronic: March 31 | |

Social security benefits for the year | Filed by the Social Security Administration directly |

In order to file these forms, employers must collect W9, W8-BEN, or W8-BEN-E forms to ensure they have the proper reporting information for their payees. To learn more about the differences of these forms, check out our other blog post on this subject.

A more recent act will also influence how we use 1099s; the One Big Beautiful Bill Act (OBBBA) has implemented changes in the thresholds for reporting for the 2026 tax year. For both the 1099-NEC and 1099-MISC the threshold for reporting has increased to $2,000 from $600.

If you have any questions about the above or want to learn how Franklin can support your company with 1099 reporting, please feel free to email us or schedule a call.